As a fractional CMO, when we are first engaged with a new client, one of the first questions I ask is about data – what do you capture, and what do you use to capture it?

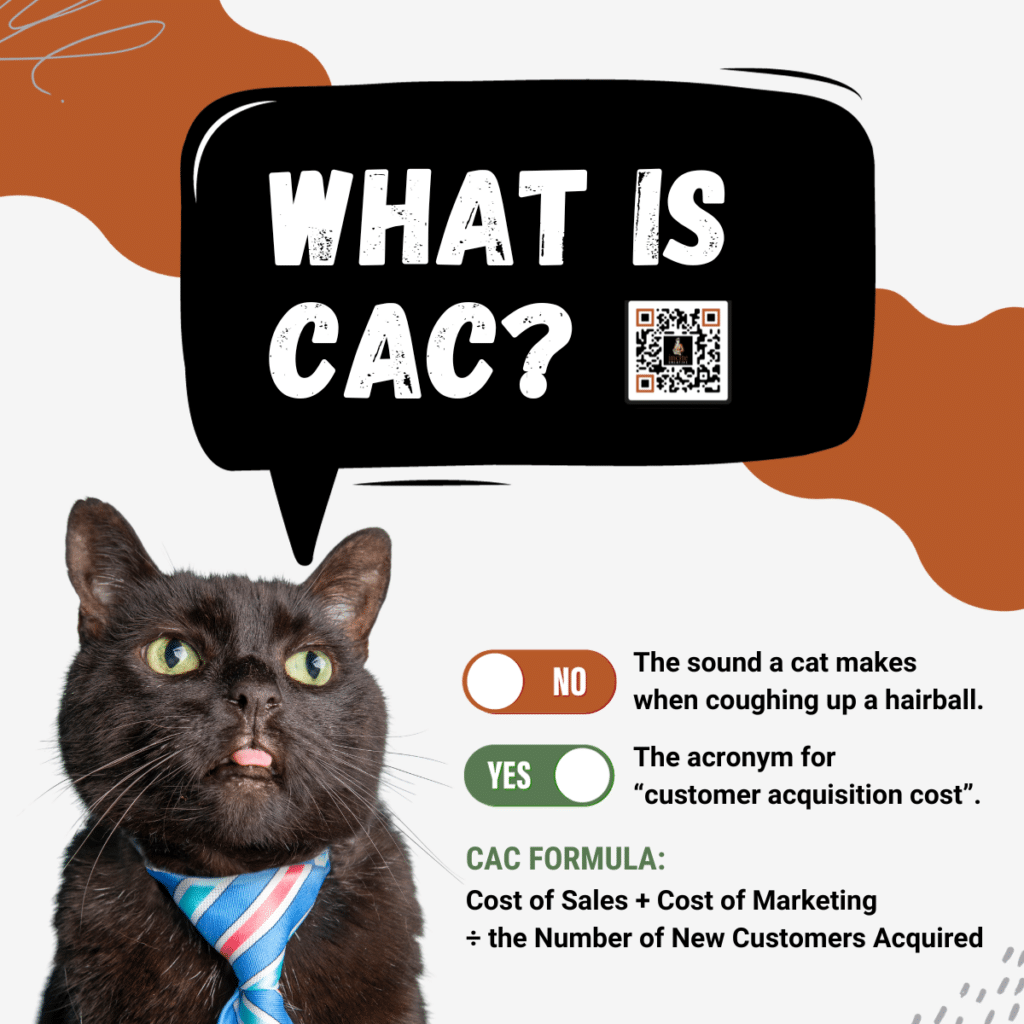

Most companies are doing a poor job and only looking at the high-level financials – incoming revenue and outgoing expenses. Fewer drill down to know their margins (beyond anecdotally or “guesstimates”), and even fewer know their CAC — the cost of customer acquisition.

For those that do share their CAC, we usually find out that it’s inaccurate. They only look at what I’ll call “hard” expenses or the most obvious, such as salaries, Adwords, and printing costs. And that’s only limited to the marketing department. Trade shows and event attendance, including meals and entertainment the sales team taps when traveling and wooing prospects, are also part of CAC.

How to Use CAC for New Year Planning

In Q4, when many companies are looking to trim the fat before they start the new year, looking at their “true” CAC is a great place to start.

It takes full transparency by marketing, sales, and finance departments to ensure that the numbers are allocated to the right place on the P&L. Once that’s done as accurately as possible, your team can highlight all of the sales and marketing tools, salaries, and costs associated with acquiring a single net new client. Then, review the list of net new active clients that excludes any pre-existing clients over the evaluated period (if the data is spotty, it is better to have one rock-solid month than 12 months of bogus data). Then, divide the two numbers to get your CAC.

Evaluate Your CAC by Considering LTV

Once you have your CAC, it may not be obvious if that number is good or bad. To know if $$$ CAC per client is too high or too low, you need to consider a single client’s lifetime value (LTV).

For example, in the vacation rental business, let’s assume a property owner plans to rent for 10 years. Well, in year one, the property owner and the property management company will lose money due to fixing up the unit to attract renters and marketing the property through digital advertising, OTA sites, email, social media, and other distribution channels. However, the LTV of a single property maintained for a much more nominal cost, using a 10-year average, makes that initial investment and CAC a smart move. Both the property owner and the VRM company will make a nice profit in the long run.

However, a technology company that spends a lot to get one customer and loses them after one year is a bad investment. Now, if that customer continues to subscribe for 5-10 years and becomes a referral partner, even after a percentage commission is distributed, the SaaS company’s profit from the LTV of that one client makes a higher CAC a wise investment.

Knowing Your Numbers is All Part of the Plan

Beyond revenue and expenses, knowing your CAC and your LTV can shed light on how well your marketing and sales efforts are performing. It can also help you uncover some funds you can save or reallocate in areas that will provide better and more profitable results.

If you need help with this process, contact us at 410-366-9479 or [email protected]. It’s part of our marketing strategy services, and this is an excellent time of year to look behind the curtain and get to know the meaning of your numbers.

About Incite Creative, Inc.: Incite Creative is a marketing advisory firm that provides outsourced CMO services. In short, we become your company’s chief marketing officer and do so virtually and efficiently — saving you time and money. Since 1999, we’ve enjoyed building and boosting brands for a core set of industries. Our thoughtful process, experienced team, and vested interest in our client’s success have positioned us as one of the Mid-Atlantic’s most sought-after marketing partners for those looking to grow their brand awareness and bottom line. Stop paying for digital and traditional services you may not need. Our retainer, no markup model means our recommendations don’t come with any catch or commission. Our advice aligns with what you need and what fits within your budget. For more information, contact us at 410-366-9479 or [email protected].